Risk Management in PrimeXBT Crypto Trading

Risk management in PrimeXBT crypto trading is crucial for achieving consistent profitability and safeguarding your investment. Understanding and applying risk management strategies effectively can significantly reduce potential losses.

Introduction to Risk Management

Risk management involves identifying, assessing, and prioritizing risks followed by coordinated efforts to minimize, control, and monitor the impact of those risks. In the volatile world of cryptocurrency trading, effective risk management can be the difference between success and failure.

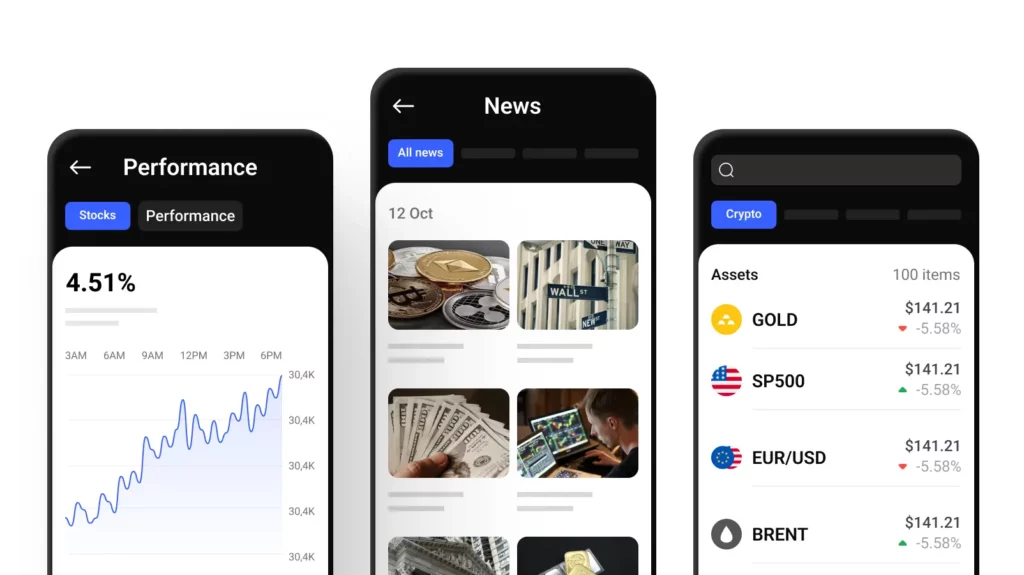

PrimeXBT, a popular trading platform, offers a range of tools and features designed to help traders manage their risk effectively. Whether you are a novice trader or a seasoned professional, understanding these tools and how to use them is essential.

| Term | Definition |

|---|---|

| Leverage | The use of borrowed capital to increase the potential return of an investment. |

| Stop-Loss Order | An order placed with a broker to buy or sell once the stock reaches a certain price. |

| Risk-Reward Ratio | A ratio used by traders to compare the expected returns of an investment to the amount of risk undertaken. |

| Volatility | The degree of variation of a trading price series over time, usually measured by standard deviation. |

| Liquidity | The availability of liquid assets to a market or company. |

Understanding Leverage in PrimeXBT

Leverage is one of the most powerful tools available to traders on PrimeXBT. It allows traders to open positions much larger than their actual account balance, amplifying both potential gains and losses. This double-edged sword requires careful management.

Traders must understand the implications of leverage on their trading strategy and risk management plan. High leverage can lead to significant profits, but it can also result in substantial losses, especially in a highly volatile market like cryptocurrency.

- Start with low leverage: New traders should begin with the lowest leverage to understand how it affects their trades.

- Monitor margin levels: Keeping an eye on your margin levels helps prevent margin calls and liquidation.

- Use stop-loss orders: Implementing stop-loss orders can help protect your investment from significant losses.

- Stay informed: Keeping up-to-date with market news and trends can help you make informed decisions about leverage.

- Regularly review your strategy: Continuously assess and adjust your leverage strategy to align with your risk tolerance and market conditions.

Effective leverage management can enhance your trading experience and profitability on PrimeXBT. By starting with low leverage, monitoring margin levels, and using stop-loss orders, traders can mitigate risks and make more informed decisions.

Adapting your leverage strategy as you gain experience and as market conditions change is crucial. Being disciplined and cautious with leverage will help you build a more resilient trading approach.

Implementing Stop-Loss Orders

Stop-loss orders are essential tools in risk management. They automatically close a position when it reaches a predetermined price, helping to limit potential losses. Understanding how to set and adjust stop-loss orders can significantly impact your trading outcomes.

PrimeXBT offers flexible stop-loss order options, allowing traders to customize their risk management strategies according to their individual needs and market conditions. Learning to use these effectively is a key component of successful trading.

- Determine your risk tolerance: Decide how much of your capital you are willing to risk on a single trade.

- Set your stop-loss level: Choose a price point at which you will exit the trade to prevent further losses.

- Use trailing stop-losses: This dynamic approach moves the stop-loss level as the market price moves in your favor, locking in profits while minimizing risks.

- Regularly review and adjust: Continually monitor your stop-loss orders and adjust them based on market conditions and your evolving trading strategy.

- Stay disciplined: Stick to your stop-loss strategy to avoid emotional decision-making and impulsive trading actions.

Setting appropriate stop-loss orders can protect your investment and help maintain a balanced trading approach. Determining your risk tolerance, using trailing stop-losses, and regularly reviewing your strategy are fundamental practices.

Maintaining discipline in executing stop-loss orders is vital for long-term success. By preventing significant losses and locking in profits, stop-loss orders contribute to a robust risk management framework.

Evaluating Risk-Reward Ratio

The risk-reward ratio is a crucial metric for traders. It compares the potential profit of a trade to the potential loss, helping traders make more informed decisions about which trades to pursue. A favorable risk-reward ratio is essential for consistent profitability.

PrimeXBT’s platform provides tools to calculate and evaluate the risk-reward ratio for each trade. By analyzing this ratio, traders can develop strategies that align with their financial goals and risk tolerance.

- Set clear goals: Define your target profit and acceptable loss for each trade.

- Analyze potential trades: Assess the risk-reward ratio before entering any trade.

- Prioritize high reward trades: Focus on trades with higher potential rewards relative to their risks.

- Adjust strategies: Modify your trading strategies to improve your risk-reward ratio over time.

- Monitor performance: Regularly review the outcomes of your trades to ensure your risk-reward strategies are effective.

Evaluating the risk-reward ratio helps traders focus on high-potential trades while managing their risks. Setting clear goals, analyzing potential trades, and prioritizing high-reward opportunities are key steps in this process.

Regularly adjusting strategies and monitoring performance ensures that your risk-reward approach remains effective and aligned with your trading objectives. This continuous improvement fosters a more disciplined and profitable trading experience.

Understanding Market Volatility

Market volatility is a significant factor in crypto trading. The cryptocurrency market is known for its rapid price fluctuations, which can present both opportunities and risks. Understanding and managing volatility is essential for successful trading.

PrimeXBT provides various tools and resources to help traders navigate volatile markets. By leveraging these tools, traders can develop strategies to capitalize on price movements while mitigating potential losses.

- Stay informed: Keep abreast of market news and trends to anticipate potential volatility.

- Use technical analysis: Employ technical indicators to understand market patterns and predict price movements.

- Set realistic expectations: Understand the inherent risks of volatile markets and set achievable trading goals.

- Maintain a diversified portfolio: Spread your investments across different assets to reduce risk exposure.

- Utilize volatility indicators: Use tools like Bollinger Bands and the Average True Range (ATR) to gauge market volatility.

Managing market volatility requires a combination of staying informed, using technical analysis, and setting realistic expectations. Diversifying your portfolio and utilizing volatility indicators can further help in mitigating risks.

By adopting a proactive approach to volatility, traders can enhance their ability to navigate market fluctuations effectively. This strategy not only helps in protecting investments but also in identifying profitable opportunities.